Woocommerce | Tax Exempt

Updated on: October 16, 2025

Version 1.9.2

Single Purchase

Buy this product once and own it forever.

Membership

Unlock everything on the site for one low price.

Product Overview

Simplify your eCommerce operations with the WooCommerce Tax Exempt plugin. This powerful tool allows you to easily manage tax exemptions for your customers, streamlining the checkout process and enhancing user experience. No more complicated calculations or confusing tax rules; with this plugin, you can set up tax-exempt statuses for individual customers or groups with just a few clicks. Plus, it integrates seamlessly with your existing WooCommerce setup, making it a hassle-free addition to your online store. Whether you're catering to non-profit organizations or wholesale buyers, this plugin ensures compliance while saving you valuable time.

Key Features

- Effortlessly set tax-exempt status for individual customers or specific groups.

- Seamless integration with your existing WooCommerce store.

- Automatic adjustment of tax calculations at checkout.

- Customizable exemption reasons to suit your business needs.

- User-friendly interface for quick setup and management.

- Comprehensive support for various tax regulations and compliance.

- Detailed reporting features to track tax-exempt sales.

- Regular updates to ensure compatibility with the latest WooCommerce versions.

Installation & Usage Guide

What You'll Need

- After downloading from our website, first unzip the file. Inside, you may find extra items like templates or documentation. Make sure to use the correct plugin/theme file when installing.

Unzip the Plugin File

Find the plugin's .zip file on your computer. Right-click and extract its contents to a new folder.

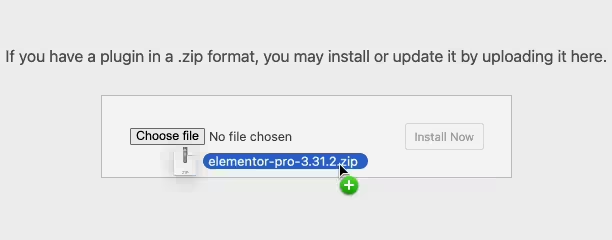

Upload the Plugin Folder

Navigate to the wp-content/plugins folder on your website's side. Then, drag and drop the unzipped plugin folder from your computer into this directory.

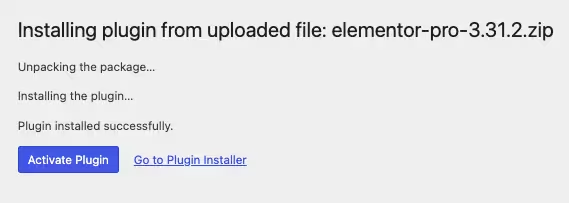

Activate the Plugin

Finally, log in to your WordPress dashboard. Go to the Plugins menu. You should see your new plugin listed. Click Activate to finish the installation.

PureGPL ensures you have all the tools and support you need for seamless installations and updates!

For any installation or technical-related queries, Please contact via Live Chat or Support Ticket.