EU VAT for Easy Digital Downloads

Updated on: December 28, 2025

Version 1.7.4

Single Purchase

Buy this product once and own it forever.

Membership

Unlock everything on the site for one low price.

Product Overview

Managing VAT compliance in the EU can be daunting, especially for digital goods. The "EU VAT for Easy Digital Downloads" plugin simplifies the entire process, ensuring you stay compliant while focusing on your business. With seamless integration into your existing EDD setup, this tool automatically calculates VAT based on your customers' locations. Plus, it generates the required invoices, saving you time and reducing stress. What makes it stand out is its user-friendly interface, allowing even those without extensive technical knowledge to navigate effortlessly. Take control of your VAT obligations with this essential plugin.

Key Features

- Automatic VAT calculation based on customer location.

- Seamless integration with Easy Digital Downloads.

- Customizable invoice generation to meet EU requirements.

- Simple setup process, no coding skills required.

- Regular updates to keep compliance with changing regulations.

- Detailed reporting features for easy tracking of VAT collected.

- Support for multiple currencies for international sales.

- User-friendly interface for efficient management.

Installation & Usage Guide

What You'll Need

- After downloading from our website, first unzip the file. Inside, you may find extra items like templates or documentation. Make sure to use the correct plugin/theme file when installing.

Unzip the Plugin File

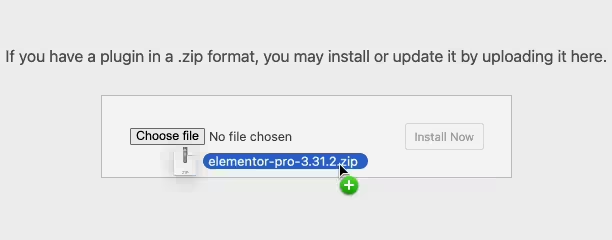

Find the plugin's .zip file on your computer. Right-click and extract its contents to a new folder.

Upload the Plugin Folder

Navigate to the wp-content/plugins folder on your website's side. Then, drag and drop the unzipped plugin folder from your computer into this directory.

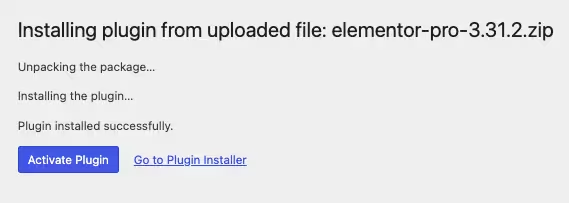

Activate the Plugin

Finally, log in to your WordPress dashboard. Go to the Plugins menu. You should see your new plugin listed. Click Activate to finish the installation.

PureGPL ensures you have all the tools and support you need for seamless installations and updates!

For any installation or technical-related queries, Please contact via Live Chat or Support Ticket.